September 2024 Market Overview

In September, global financial markets experienced a mixed yet overall positive performance. US equities reached new highs, which was fueled by a 0.50% interest rate cut by the US Federal Reserve. Meanwhile, China’s stock market surged following the government’s announcement of new stimulus measures to combat its ongoing economic slowdown.

Geopolitically, escalating conflict in the Middle East, remains a significant risk factor as the year progresses. Gold prices reached new highs and oil prices fluctuated, with Brent crude briefly dropping below $70 per barrel.

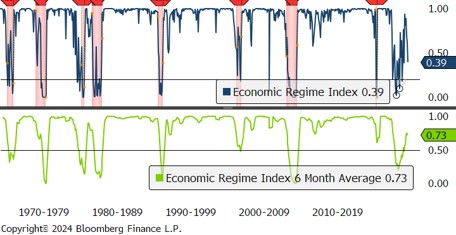

The recent decline in the Economic Regime Index, indicates increasing economic uncertainty. Historical patterns suggest potential recessionary signals when the index dips below the 0.4 level, as highlighted by the shaded regions and the current 0.39 reading.

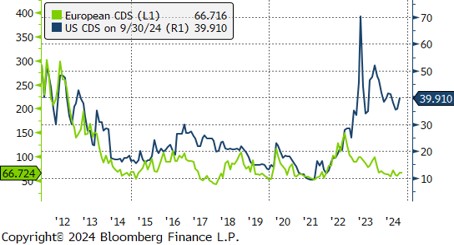

In September, the credit default swaps (CDS) for both European financials and US entities have seen a slight increase compared to August. Despite this small uptick, credit risk remains significantly lower than the peak levels observed in 2022, indicating that the financial environment is still relatively stable.

INTERESTING

Factors influencing the FTSE/JSE All Share Index

Momentum has clearly been the dominant factor. Over extended periods of 10, 20 and 30 years, the momentum factor consistently delivers the highest returns, significantly outperforming other factors, reinforcing the long-term dominance of momentum strategies within the FTSE/JSE All Share Index.

PERFORMANCE

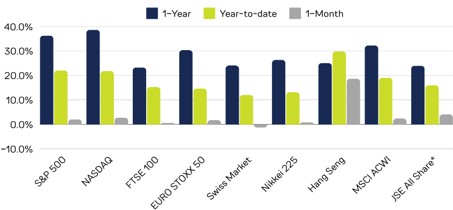

The majority of markets saw positive returns in September, with China’s Hang Seng leading the way with an impressive 18.7% gain, followed by the JSE All Share Index at 4.1%.

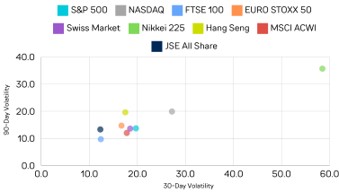

In comparison to August, the majority of indices show lower 30-day volatility, suggesting increased market stability. Notably the Nikkei’s 30-day volatility has sharply declined from its position in August, whereas the Hang Seng’s 30-day volatility increased.