August 2025 Market Overview

This earnings season has highlighted a widening gap between winners and losers. S&P 500 companies missing earnings expectations have suffered their steepest underperformance in years, with investors showing little tolerance for disappointment even as beats are met with only modest gains. A similar pattern has unfolded in Europe, where Euro Stoxx 50 constituents missing estimates have also been hit with record share price declines. The reaction underscores a market environment where resilience is rewarded but any misstep is swiftly penalised, reflecting elevated scrutiny from investors in both regions.

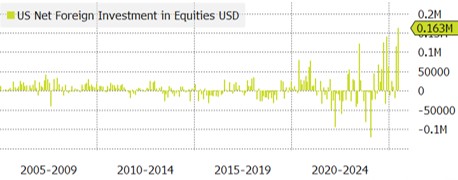

Record Inflows Signal Renewed US Optimism

Foreign demand for US equities has accelerated sharply, with June seeing a record $163 billion in inflows. The once-prominent “sell America” narrative has lost traction as investors increasingly embrace US assets, particularly in technology, where the AI theme continues to drive global interest. Currency hedging of dollar holdings has also waned, suggesting that international investors are positioning more confidently in US markets. While local participants often highlight fiscal and political risks, global investors appear focused on relative growth strength and corporate resilience. It also illustrates how quickly sentiment can shift, as global flows chase performance despite underlying economic uncertainties.

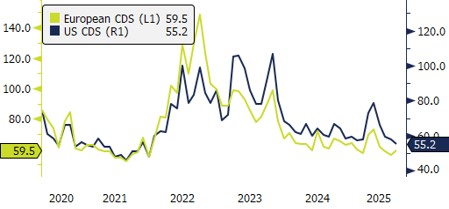

Credit Default Swaps

US and European CDS spreads stayed close to multi-year lows in August, with US levels easing slightly while European spreads edged higher. US credit spreads narrowed to their tightest point in more than twenty years, lifted by optimism that a severe global trade war can be avoided. While this signals confidence in corporate resilience, we remain cautious that credit markets may not be fully pricing the risks posed by rising tariffs and softer economic data.

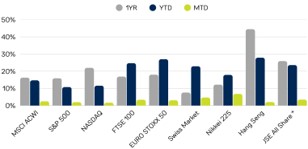

Performance

* JSE All Share Index, shown in ZAR

Global equities gained further ground in August, with the MSCI ACWI up 2.5% and year-to-date returns improving to 14.7%. The Nikkei 225 surged 6.8%, marking its best monthly performance this year. The JSE All Share added 3.5% in August, remaining among the strongest global performers.

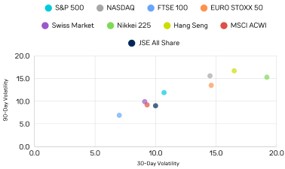

30-day volatility edged higher in August, with most major indices recording a pickup in short-term swings. The NASDAQ and Nikkei 225 led the rise, while the S&P 500 also saw a modest increase. European moves were mixed, with the Euro Stoxx 50 slightly firmer but the Swiss Market easing. Meanwhile, 90-day volatility declined across most indices.