November 2025 Market Overview

November delivered a more volatile and mixed performance across equity markets. The NASDAQ rebounded toward month-end after a heavy selloff, but still recorded its first monthly decline since March, weighed down by a brief pullback in AI-exposed shares amid renewed “bubble” debate. In the US, the end of the government shutdown provided some relief, although delayed and limited economic data has added uncertainty around the Fed’s 10 December rate decision. The Fed’s halt to quantitative tightening on 1 December signals a shift toward easier liquidity conditions. Locally, S&P Global Ratings upgraded South Africa’s credit rating for the first time in nearly two decades.

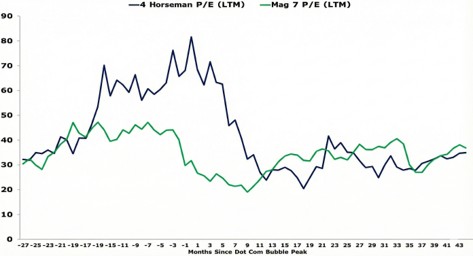

Today’s Tech Giants vs. the Dot-Com Era

During November, discussions around a potential AI bubble resurfaced, with some highlighting richer valuations and occasional signs of speculative behaviour. The chart above compares the trailing P/E ratios of today’s Magnificent Seven with the “Four Horsemen” of the late-1990s dot-com era, which shows a notable difference in valuation dynamics. In the lead-up to 2000, the Four Horsemen saw their multiples rise from the low 30s to above 80x, supported largely by optimism rather than profitability. In contrast, the Magnificent Seven have operated within a narrower range, underpinned by stronger earnings, healthier balance sheets and looser financial conditions. While pullbacks are natural after a strong run, current valuations appear more measured than the extremes witnessed during the dot-com period.

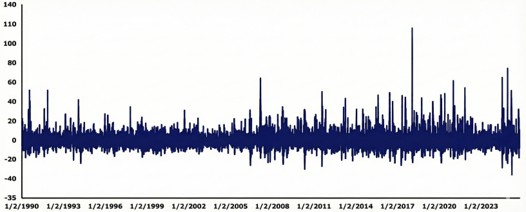

Daily VIX Percentage Changes

The chart above illustrates how the pattern of daily VIX movements has changed over time. The VIX, one of the leading measures of market volatility, now shows far more frequent and pronounced daily swings than in earlier decades. Since 2020, it has averaged close to 21, almost 40% higher than its 2015–2020 average, pointing to a market environment operating on a higher baseline of uncertainty. The volatility environment has changed structurally, with moves that were once rare now forming a regular part of market behaviour. Markets have become more sensitive to triggers such as macro news, geopolitical developments and liquidity shifts, resulting in faster drawdowns and equally rapid recoveries.

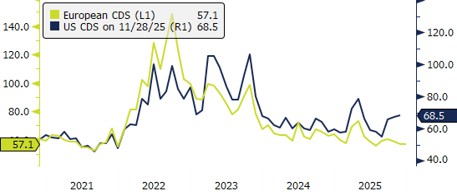

Credit Default Swaps

In November, European credit risk continued to ease, with EU CDS spreads trending lower throughout the month. In contrast, US CDS spreads remained higher and more volatile, rising earlier in the month before pulling back slightly toward month end.

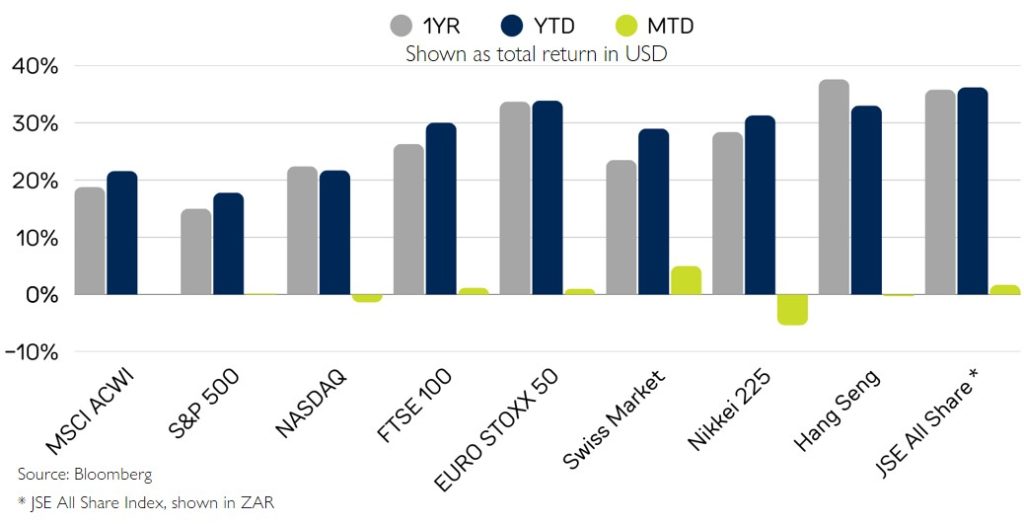

Performance

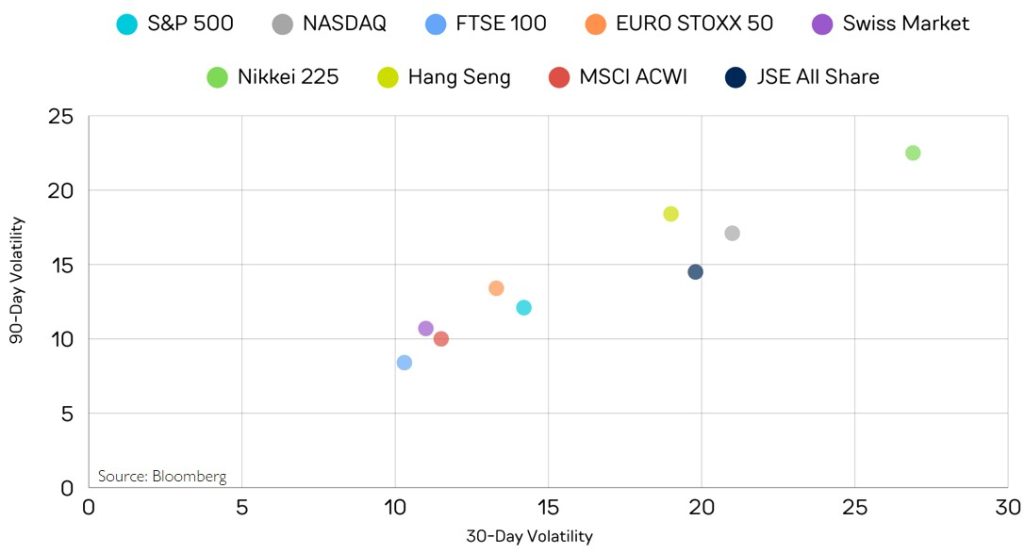

Global equity markets delivered a mixed performance in November. The MSCI ACWI was flat for the month, while the NASDAQ slipped into negative territory. Europe remained broadly resilient, and the Swiss Market stood out with a strong 5% gain. Japan saw a sharp reversal, with the Nikkei 225 falling 5.4% after an 11.8% surge in October.

Overall, volatility continued to build on the pickup seen in October, signalling a gradually more uncertain market backdrop into year end. The NASDAQ and JSE All Share recorded the largest rises in 30-day volatility, while the Swiss Market and Hang Seng were the only indices where short-term volatility declined.