December 2025 Market Overview

The Fed cut interest rates by 25bps in December, as widely expected, marking the third-rate reduction in 2025. The year began with the DeepSeek episode, which proved short-lived as enthusiasm around artificial intelligence strengthened over the course of the year. This was followed by President Trump’s Liberation Day tariff announcements and the renewed trade tensions that accompanied them. Ongoing debate around US exceptionalism, continued geopolitical tensions, expectations of Fed rate cuts, and a US government shutdown all contributed to an unusually eventful year for financial markets. Despite these developments, markets proved resilient and ended 2025 on a strong footing.

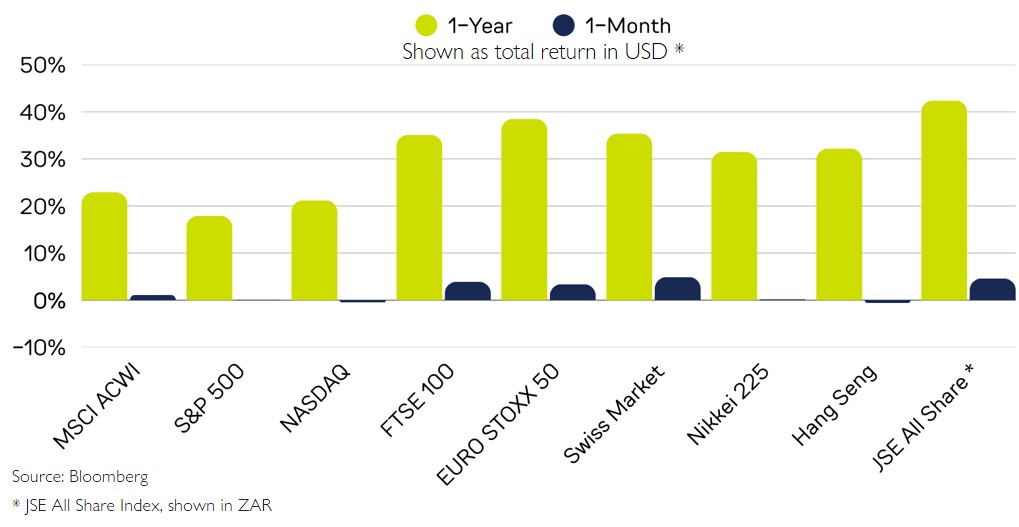

2025 Global Market Performance at a Glance

Gold delivered its strongest performance in decades, supported by heightened macroeconomic and geopolitical uncertainty and strong central bank demand, among other contributing factors. Equity markets also had a strong year, with all major regions recording double-digit growth in 2025, led by emerging markets despite early concerns that US tariffs would weigh on export-focused economies. The US dollar weakened materially over the year as markets priced in expectations of Federal Reserve rate cuts and elevated policy uncertainty, while oil prices declined amid oversupply concerns, high production levels and softer demand expectations.

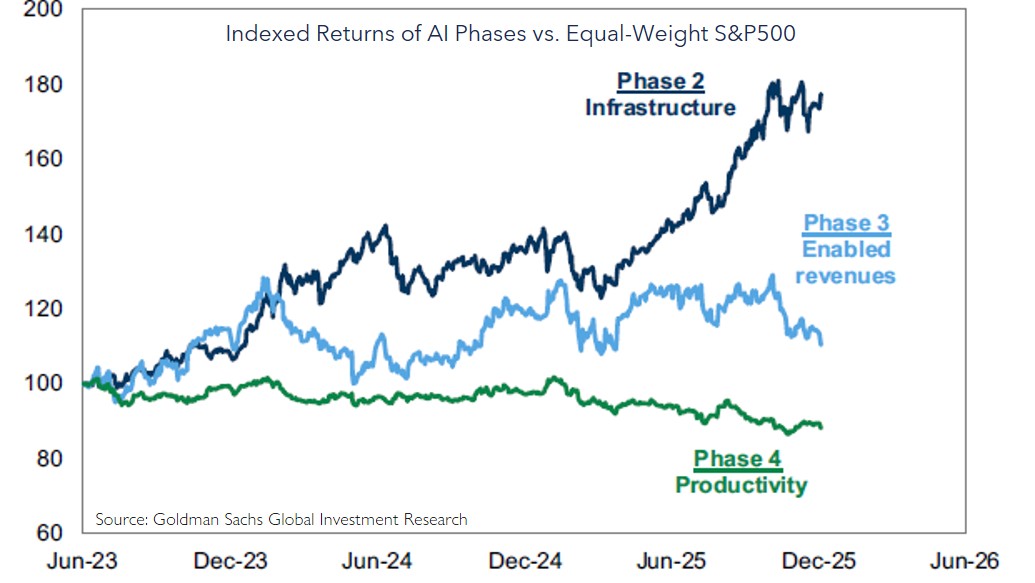

Phases of the AI Trade

Artificial intelligence was a defining market theme in 2025 and is likely to remain central to investor discussion in 2026. To date, performance has largely reflected the early stages of the AI cycle, with the most visible beneficiaries, particularly semiconductor manufacturers and data centre–related companies, outperforming, while AI-enabled revenue and productivity beneficiaries have broadly tracked the wider market. As AI adoption continues to expand, investor focus may gradually broaden toward companies generating revenues from AI integration and those applying AI to improve operational efficiency. Recent earnings results, have begun to offer selective evidence of companies quantifying the impact of AI efficiency gains on profitability.

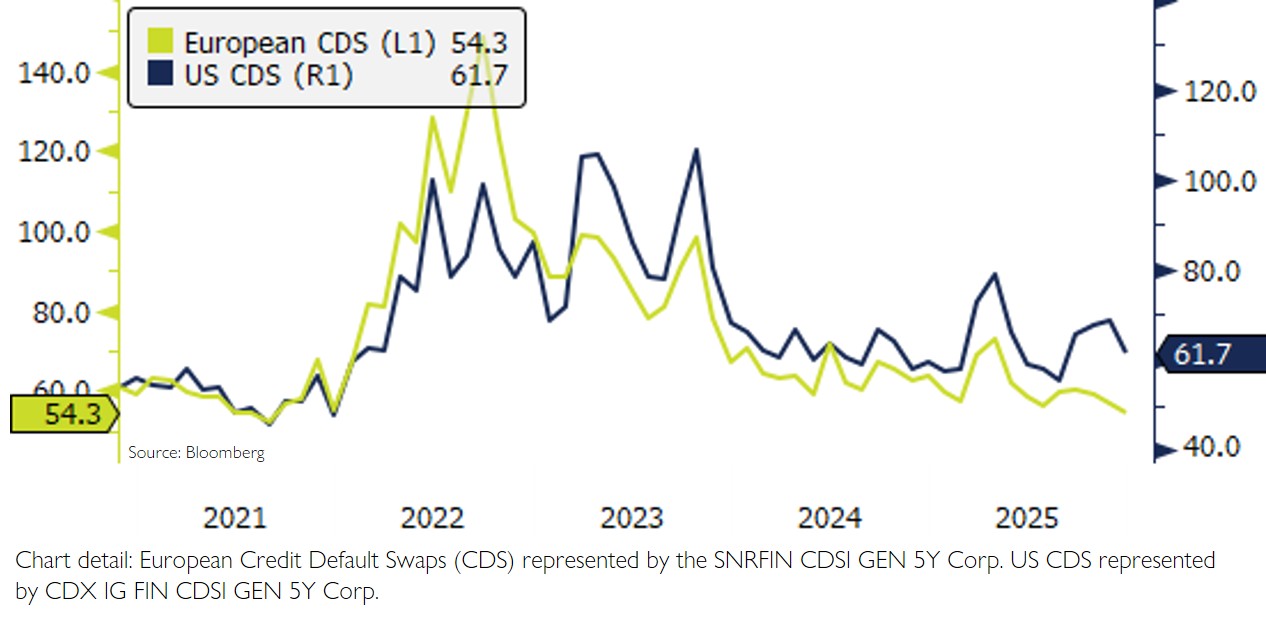

Credit Default Swaps

US and European CDS spreads eased into year-end, consistent with broader market evidence of tighter credit spreads. Both regions saw CDS levels decline in December, with US CDS falling from 68.5 to 61.7 and European CDS easing from 57.1 to 54.3.

Performance

December performance was generally positive, particularly locally and across European markets. Equity markets delivered broad-based gains over the year, led by European indices, which each returned over 35% in dollar terms. Asian markets also performed strongly, posting gains above 30% in dollar terms. The JSE All Share was a standout performer, delivering a 42.5% return for the year, while US equities recorded solid but more moderate gains, with the S&P 500 and NASDAQ up 17.9% and 21.2% respectively.

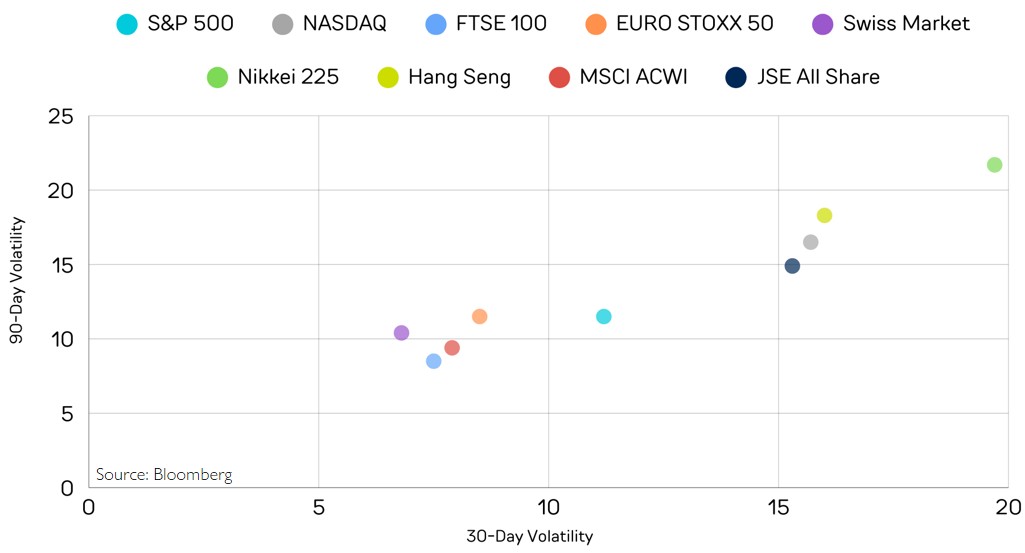

Market volatility declined into year-end, with 30-day volatility easing across most major indices in December. This was particularly evident in developed markets, where short-term volatility fell below longer-term averages, signaling a calmer market environment.