May 2025 Market Overview

Global equity markets rebounded strongly in May, recovering much of the year’s earlier weakness. The Fed and BoJ held interest rates steady, while the ECB, BoE and SARB delivered small cuts. The U.S. and China agreed to a 90-day mutual tariff reduction as talks continue. Trump’s Middle East tour drew headlines with over $1 trillion in deals, reflecting closer political and economic ties. His threat to impose sweeping EU tariffs unsettled markets, though implementation was delayed. A U.S. court ruling blocked key Trump-era tariffs, offering temporary relief, but investors remain cautious amid speculation the White House may pursue alternative trade measures.

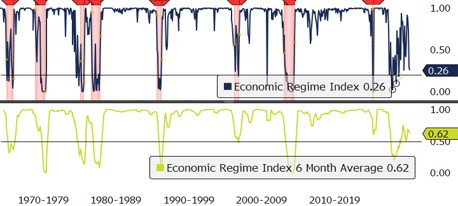

Index Shows US Macro Fragility Deepening

The Bloomberg Economic Regime Index fell to 0.26 in April, its weakest reading since July 2024 and just above recession territory, defined as readings below 0.20. The decline reflects rising jobless claims and persistently low consumer sentiment. While the model showed signs of recovery in 2023 and early 2024, it has failed to stabilise above 0.90, a level typically associated with sustained expansions. This marks nearly three years without a meaningful recovery, highlighting ongoing fragility in the US macro-outlook.

US 30-Year Yields Hit Multi-Year Highs

Long-end yields surged in May as fiscal and political pressures came to a head. The U.S. 30-year Treasury yield jumped to its highest level in nearly two years, approaching 5%, following soft demand at a 20-year bond auction. The move reflects growing investor concern over America’s fiscal outlook, with the IMF projecting U.S. debt-to-GDP to reach 128% by 2030, on par with France and Italy and surpassing Greece. Yields have climbed steadily since Trump’s tariff announcement on 2 April and were further jolted by Moody’s decision to downgrade the U.S., stripping it of its last remaining AAA credit rating among the three major rating agencies.

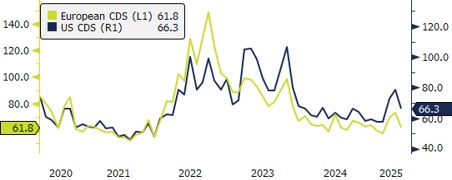

Credit Default Swaps (CDS)

Chart detail: European Credit Default Swaps (CDS) represented by the SNRFIN CDSI GEN 5Y Corp. US CDS represented by CDX IG FIN CDSI GEN 5Y Corp.

CDS levels narrowed in May, with European CDS falling from 73.2 to 61.8 and US CDS from 78.8 to 66.3. The move reflects improved investor confidence, supported by strong equity gains, easing volatility, and more stable inflation data. The ECB’s recent rate cut signaled a shift to a more accommodative stance, while the Fed kept rates on hold, maintaining a cautious, data-driven approach amid ongoing trade-related uncertainty.

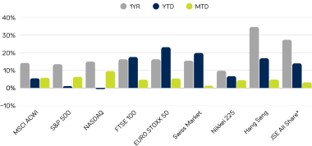

Performance *

* JSE All Share Index, shown in ZAR

Global equities rebounded in May, with the MSCI ACWI up 5.8%, lifting its YTD return to 5.5%. US markets rallied, as the S&P 500 rose 6.3% and the NASDAQ surged 9.6%, trimming earlier losses. European indices extended gains, with the EURO STOXX 50 up 5.4% in May and 23.2% YTD in dollar terms.

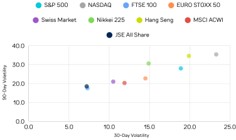

Market volatility eased in May amid calmer sentiment and improved macro clarity. The S&P 500’s 30-day volatility dropped from 42.9 to 18.9, while the NASDAQ fell from 52.1 to 23.3. Europe followed suit, with volatility moderating in the EURO STOXX 50 and Swiss Market. The FTSE 100 and JSE All Share saw the lowest short-term volatility at 7.3 and 7.2 respectively.