November 2024 Market Overview

November was characterised by robust U.S. equity performance, influenced by political developments and central bank policies. In contrast, European and Chinese markets faced declines due to concerns over potential U.S. trade policies and domestic economic challenges. The U.S. dollar strengthened significantly, marking its most substantial consecutive monthly gains in over two years. Central banks, including the U.S. Federal Reserve and the Bank of England, reduced interest rates by 25 basis points, aiming to support economic growth. Despite these cuts, bond markets saw limited gains, influenced by expectations of future U.S. fiscal policies and currency movements.

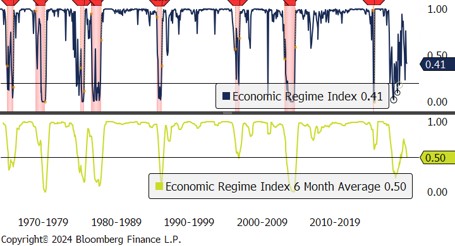

The economic regime model has struggled to stabilise in a healthy range since early 2022, with readings falling to around 0.4 in September and October, signaling weak but not recessionary activity. After peaking in May 2024, the six-month rolling average is now declining, reflecting a loss of momentum that could pressure equities.

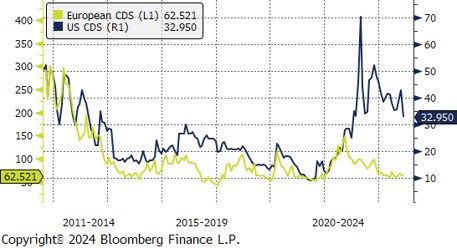

The above graph shows a decline in both U.S. credit risk and European credit risk in November. U.S credit risk, though elevated from historical lows, continue narrowing, signaling regional credit stabilisation.

INTERESTING

Thus far, gold has delivered an impressive 28% return since the start of the year, driven by geopolitical tensions, heightened uncertainty fueling demand for safe-haven assets, record central bank gold purchases to diversify reserves, and U.S. Federal Reserve interest rate cuts that boosted its appeal. Interestingly, the S&P 500 has also achieved a similar return, underscoring the unique and complex market environment of 2024.

PERFORMANCE

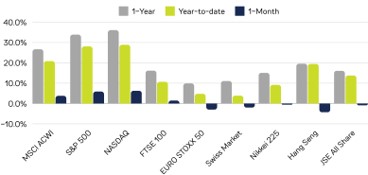

Global equity markets displayed mixed performance for November. U.S. indices demonstrated continued strength, with month-to-date returns of 6.3% and 5.9%, further reinforcing the sustained investor optimism in the U.S. markets.

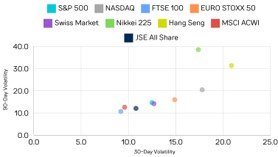

Global equity market volatility experienced notable shifts in November, with the Hang Seng and Nikkei 225 showing significant declines in short-term volatility. In contrast, the S&P 500 and NASDAQ recorded an increase in their 30-day volatility.