October 2025 Market Overview

Most major indices remained resilient through October, despite a mid-month wobble in US regional banks after isolated loan-loss and fraud concerns briefly revived memories of 2023. In the US, the Federal Reserve cut rates by 25bps, reinforcing a dovish stance amid the ongoing government shutdown, which has stalled key data releases. Geopolitically, the Trump–Xi Jinping meeting signalled cautious progress on trade but underscored lingering tensions. South Africa’s removal from the FATF greylist lifted local sentiment. Globally, earnings season began with mixed results. Overall, markets ended the month balancing policy easing, credit risk concerns, and geopolitical caution, leaving volatility elevated.

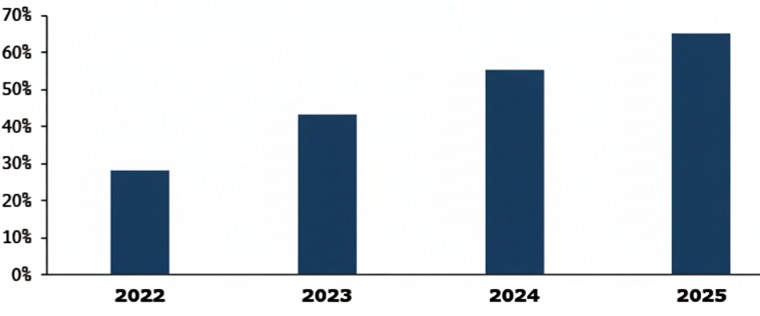

Rising S&P 500 Dependence on Magnificent Seven

The influence of the Magnificent Seven on the S&P 500 has grown further in 2025. As shown in the chart, the index now rises about 65% of the time even when the median of the other 493 stocks declines, up from 55% in 2024 and just 43% in 2023. This underscores how heavily market direction depends on the performance of a handful of large technology and AI-linked stocks, highlighting the growing concentration risk within the benchmark.

When Interest Turns Into More Debt

A recent Bloomberg report points to rising concern in private credit markets as payment-in-kind (PIK) lending grows rapidly. “Bad PIK”, added mid-loan to ease borrower cash flow, is increasingly viewed as a sign of borrower distress. Data from Lincoln International show a sharp rise in such loans, while JPMorgan estimates that Business Development Companies (BDCs), key vehicles in the private credit space, now hold around $43.5 billion in PIK exposure. Analysts warn that some private credit funds may be using PIK loans to obscure weakening credit quality, with defaults often disguised through loan amendments. Limited transparency in direct lending further complicates the assessment of true risk, reinforcing a cautious outlook across the market.

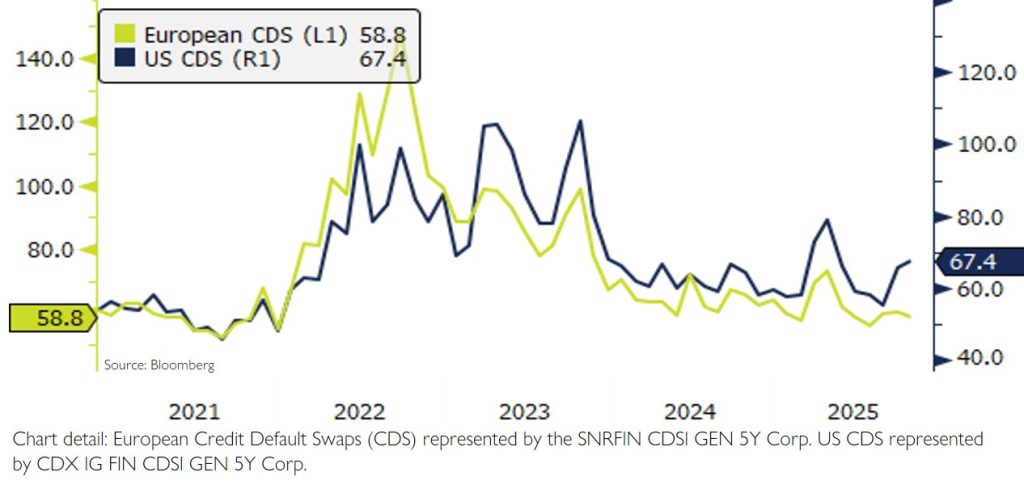

Credit Default Swaps

US CDS spreads remained elevated through October, rising slightly after a sharp uptick at the end of September. The move coincided with a brief pickup in mid-October amid renewed concerns over US regional banks. In contrast, European CDS eased slightly, supported by the ECB’s decision to keep rates unchanged and signal confidence in the region’s economic resilience, helping to stabilise credit sentiment.

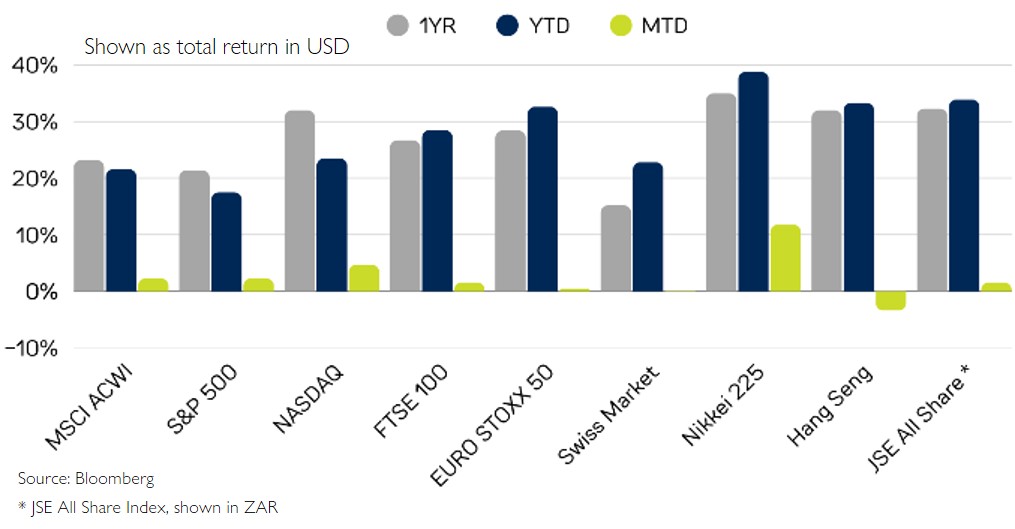

Performance

Most major indices posted positive month-to-date gains, with year-on-year returns strengthening. In the US, the S&P 500 and NASDAQ rose 2.3% and 4.7%. European markets were more subdued, with the EURO STOXX 50 up 0.5% and the FTSE 100 advancing 1.6%. In Asia, Japan’s Nikkei 225 surged 11.8%, while Hong Kong’s Hang Seng fell 3.4%.

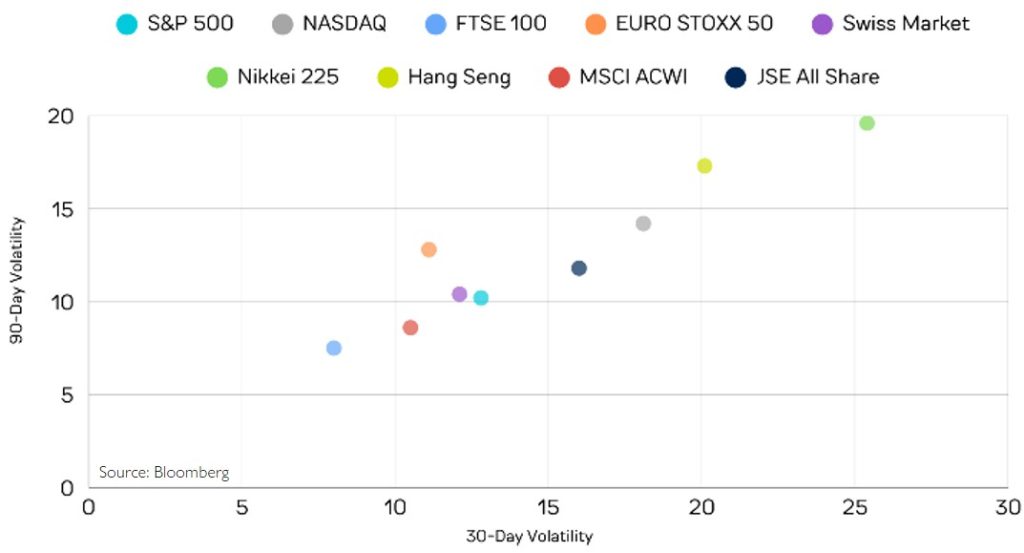

Volatility picked up across most major indices in October. The 30-day volatility of the MSCI ACWI rose to 10.5% from 6.9%, while the S&P 500 and NASDAQ also moved higher. In Asia, the Nikkei 225 jumped to 25.4% and the Hang Seng remained elevated at 20.1%. The JSE All Share also experienced higher volatility, reflecting increased market activity.