September 2025 Market Overview

September delivered another strong month for global equities, with AI-driven names leading the way and further supported by expectations of Fed easing. The Fed delivered its first rate cut since December in response to weakening labour indicators, while President Trump announced new tariffs on pharmaceuticals, medical equipment, furniture and trucks. US Q2 GDP growth surprised to the upside at 3.8%. In Europe, both the ECB and BoE kept policy steady. Locally, SA CPI surprised markets after easing to 3.3% y-o-y, whilst the market was expecting a slight uptick, and the SARB left rates unchanged. South Africa could also be removed from the “greylist” as early as next month. The month ended with the US entering a government shutdown.

Fed Balances Inflation Risks Against Job Weakness

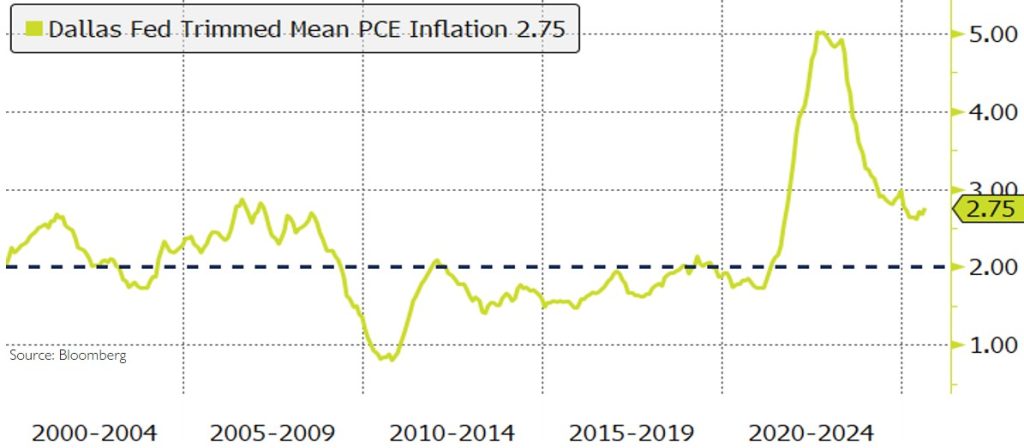

At the latest meeting, Powell signaled caution about committing to further cuts, even as markets continue to price in easing. The Fed’s preferred inflation gauge, the PCE index, ticked up to 2.7% y-o-y, while the Dallas Fed’s trimmed mean, a stricter measure that excludes extreme price moves, is also ticking up. On the labour side, payroll growth slowed substantially to just 22,000 jobs in August, though jobless claims fell sharply in mid-September, suggesting layoffs have not accelerated. These mixed signals leave the Fed weighing persistent inflation against signs of labour market softness, with the next jobs and inflation data likely to be decisive in determining whether the easing cycle continues.

Gold and Equities Break Records Together

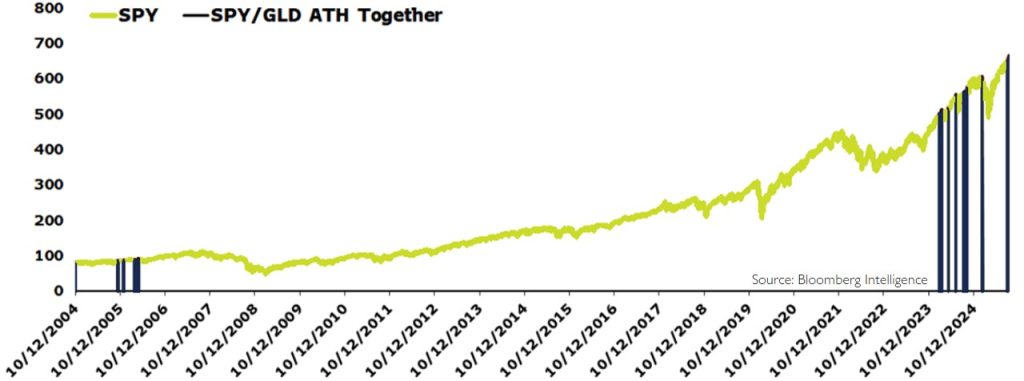

Gold and equities rarely peak together, as they are more often on diverging paths, yet both set records in September. Gold’s surge to a record $3,859/oz was driven by geopolitical tensions, strong central bank demand, expectations of looser Fed policy, and further support from a weaker dollar. A softer dollar lowers the cost of gold for foreign buyers while also boosting US equities by making them more attractive to international investors. Increasingly, gold is being used as a strategic defensive allocation alongside risk assets, rather than purely as a crisis hedge. Investors seem to be positioning for steady growth and looser Fed policy while hedging against volatility with higher gold allocations, a mix that signals optimism but also recognition of uncertainty around the durability of current conditions.

Credit Default Swaps

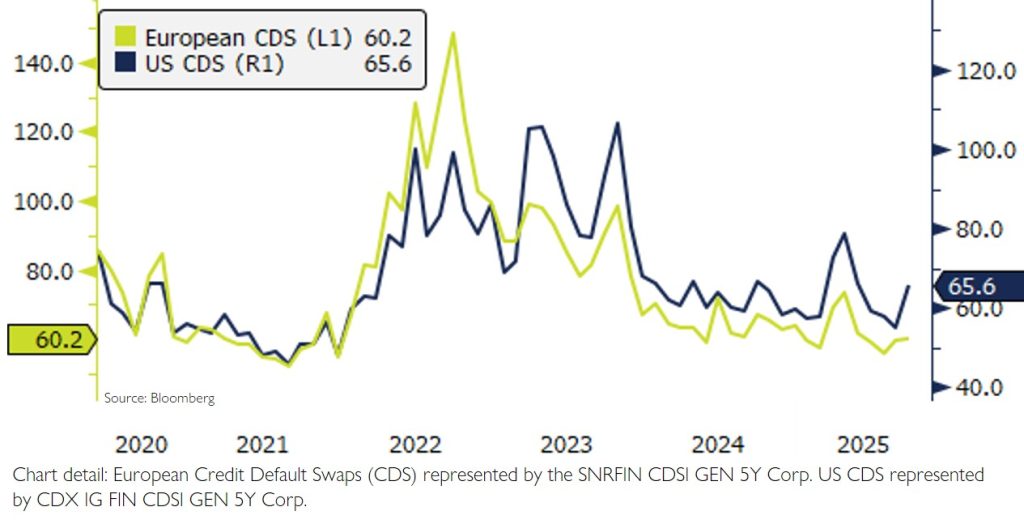

Credit markets diverged in September, with US CDS widening sharply to 65.6 (from 55.2). The move was likely driven by heavy Treasury bill issuance, which drained liquidity from already tight funding markets and raised concerns over the surge in supply. Some lingering fiscal uncertainty around a potential government shutdown, which materialised at month end, added to the cautious tone.

Performance

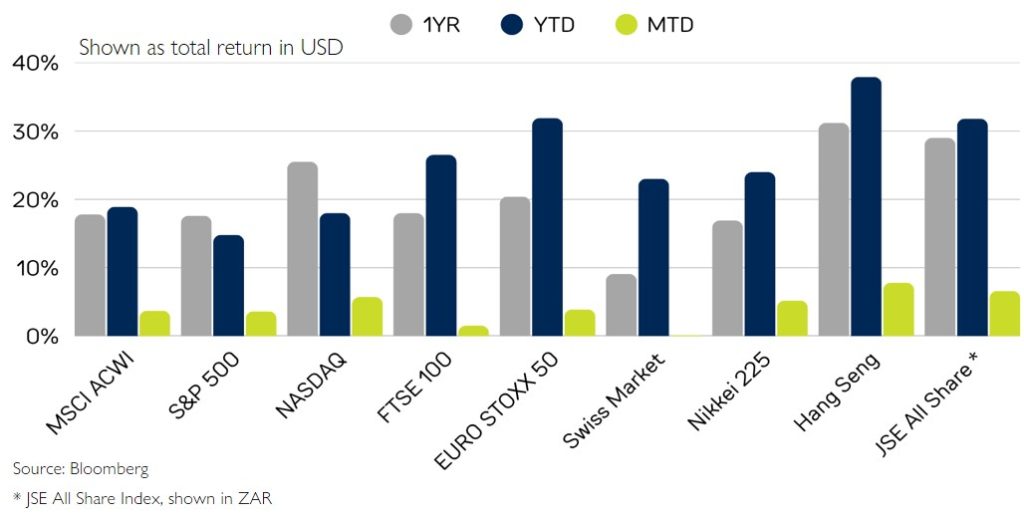

Markets pushed higher through September, with the ACWI gaining 3.7% as Asia led the advance. In the US, the Nasdaq added 5.7%, outpacing the S&P 500’s 3.6%. Closer to home, the JSE All Share stood out with a 6.6% gain, lifting its year-to-date performance to 31.8%. Precious-metal miners and gold stocks drove much of this strength, further supported by a softer dollar.

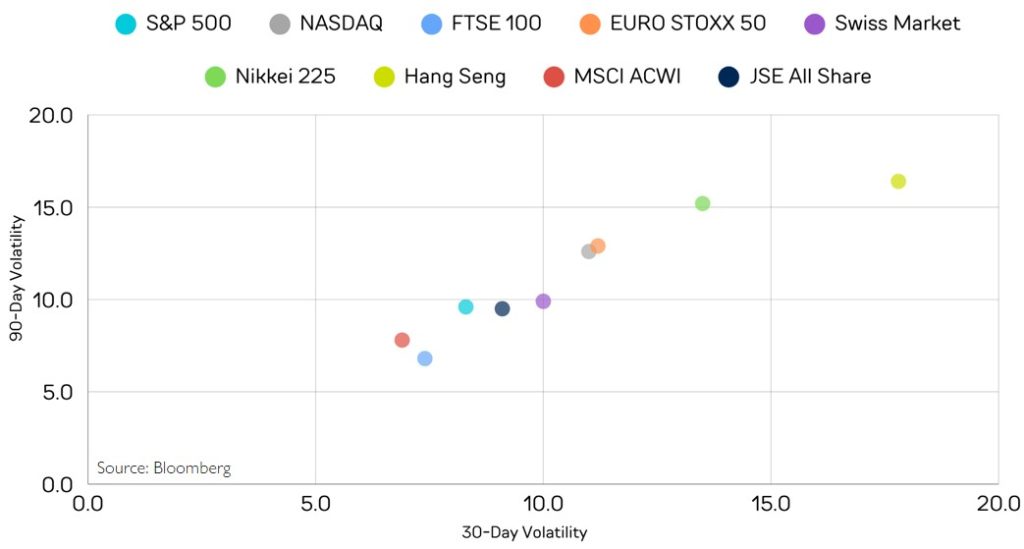

Volatility eased across most major markets in September. The S&P 500’s 30-day volatility declined to 8.3 from 10.7 in August, while the Nasdaq also moderated to 11.0 from 14.5. In Europe, the Euro Stoxx 50 eased to 11.2 from 14.6, and the MSCI ACWI slipped to 6.9, marking its lowest level this year.