October 2024 Market Overview

Global stock markets faced declines, with European indices particularly affected. Global bond markets also faced a challenging October, with Bloomberg’s Global Bond Aggregate recording one of its weakest performances in two years. Concerns over fiscal policies, persistent inflation, and geopolitical tensions contributed to this downturn. In contrast, commodities like gold, silver and oil saw gains.

We are entering the last stages of what has been dubbed the global election Superbowl. If that is the case, the US elections occupy the coveted half-time performance spot, potentially upending the whole spectacle of the game. Our processes are evidence based, leading us to observe changes in market structures as they unfold. The elections are no different and we are actively monitoring underlying shifts that inform our way of optimising either risk or performance or both.

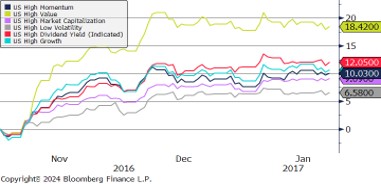

US Equity Performance by Factors after the 2016 Election

Using the equity factor performances of the US market after the Trump victory in 2016 as an example, it would be very tempting to surmise that a potential Trump victory could be beneficial for stocks that display a value characteristic. Realistically, we find ourselves in a very different fiscal, – monetary, – liquidity and geopolitical environment than in 2016.

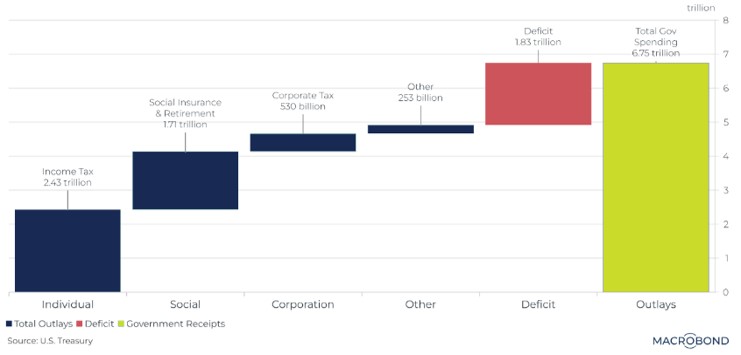

US Government Receipts vs. Outlays (Past 12 Months)

* Annual statistics calculated on 12 month rolling sum basis

As much as presidential hopefuls Trump and Harris diverge on a wide range of issues, one point of convergence is evident: both candidates’ agendas indicate that fiscal deficits are set to persist. This is one example of key forces influencing secular global economic states.

Chart detail: European Credit Default Swaps (CDS) represented by the MARKIT ITRX EUR SNR FIN 06/29. US CDS represented by US CDS EUR SR 5Y D14.

The cost of insuring large financial firms in the U.S. against potential defaults is still elevated in relation to its European peers, although still cheaper in absolute terms. European CDS spread decreased slightly to 65.4, compared to September. Meanwhile, the US CDS spread increased from 39.9 to 42.9, providing further evidence of a sustained structural shift in how global market participants price uncertainty in these markets, respectively.

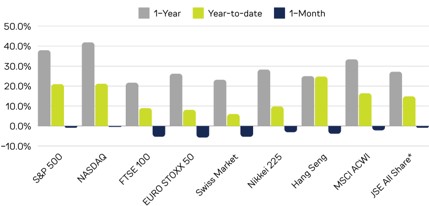

PERFORMANCE

All indices experienced a pullback in October, with the FTSE 100, Euro Stoxx 50, and Swiss Market each declining by more than 5% (in USD), reflecting broad-based caution and heightened volatility.

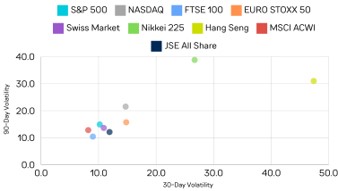

In October, we observe a general decline in 30-day volatility across several major indices compared to September. The Hang Seng Index experienced a notable jump in 30-day volatility, almost doubling from the previous month, indicating increased market turbulence in Hong Kong.