February 2025 Market Overview

February saw mixed global market performance, with US equities retreating, European indices extending gains, and Asian markets diverging, as Hang Seng surged while the Nikkei 225 struggled. Investors in U.S. bonds are shifting focus from inflation to slowing growth, fuelling a six-day Treasury rally in late February that pushed yields to yearly lows. Trump initiated 25% tariffs on Canada and Mexico and raised tariffs on China from 10% to 20%, escalating trade tensions and triggering retaliation. Gold prices surged to record highs, surpassing $2,950 per ounce, driven by safe-haven demand amid escalating trade tensions and geopolitical uncertainties.

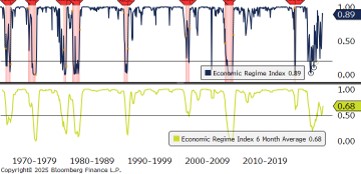

The Bloomberg Economic Regime Index has begun to recover from a prolonged downturn in late 2024, rising from 0.41 to 0.89. Historically, levels below 0.20 indicate a heightened recession risk, while those above 0.93 have been associated with the strongest forward equity returns. Despite the improving economic outlook, weak consumer sentiment, as measured by the University of Michigan Index, remains a drag on the model, even as it gradually recovers from its mid-2022 lows. These sentiment-driven headwinds could still weigh on near-term equity market performance.

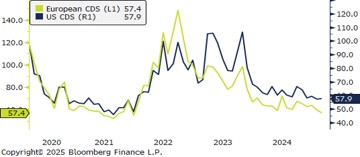

Chart detail: European Credit Default Swaps (CDS) represented by the SNRFIN CDSI GEN 5Y Corp. US CDS represented by CDX IG FIN CDSI GEN 5Y Corp.

In February, global credit markets showed mixed movements in credit default swaps (CDS), reflecting evolving risk perceptions across regions. The decline in European CDS likely reflects easing inflation concerns and a more accommodative central bank stance. Stronger-than-expected corporate earnings and renewed investor optimism have further improved credit risk sentiment. On the US front, the slight increase in CDS spreads could indicate renewed uncertainty—possibly stemming from expectations of delayed interest rate cuts, geopolitical tensions, or sector-specific pressures. Despite minor shifts, European and US CDS levels remain stable, indicating no major systemic risks at this stage. Credit spreads will likely be shaped by economic resilience and policy adjustments in the months ahead.

The S&P 500 equity risk premium is negative and below its long-term average, raising concerns about future returns. However, history shows that a negative risk premium does not always signal weak performance, as seen in two post-WWII periods with mixed stock market outcomes. The 1980-2002 stretch suggests inflation trends played a key role, with stocks declining as inflation rose, reinforcing its importance in evaluating this indicator today.

PERFORMANCE

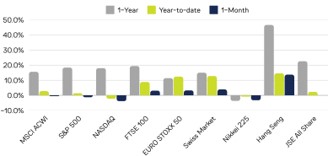

* All indices’ performance shown as total returns in USD, except for the JSE All Share Index, which is indicated in ZAR.

Global equities had a mixed performance in February, with some indices pulling back after January’s strong gains. European markets remained resilient, as the EURO STOXX 50, Swiss Market, and FTSE 100 extended their upward momentum, while the Hang Seng led gains with a double-digit jump.

Compared to January 30-day volatility declined across most indices, except for Nikkei 225 and Hang Seng, which saw increases. Meanwhile, 90-day volatility remained largely stable, with NASDAQ, Swiss Market, and JSE All Share experiencing slight upticks, while Hang Seng recorded a notable decline, suggesting waning long-term turbulence in Hong Kong but lingering uncertainty in select markets.