December 2024 Market Overview

US equity markets delivered another strong year in 2024, with the NASDAQ leading the charge, achieving a remarkable 30% return. This month marked the largest monthly aggregate of rate cuts among G10 central banks since the COVID-19 pandemic. Despite these cuts, bond markets faced challenges due to rising yields and unfulfilled expectations of monetary easing. Gold maintained its status as a safe-haven asset, with prices influenced by central bank policies and geopolitical tensions. Despite government stimulus and modest investor optimism, China continues to face significant challenges including deflationary pressures, weak domestic demand and the looming threat of potential US tariffs.

Chart detail: MSCI All Country World Index represented by MSCI ACWI Index, Gold Spot represented by Gold United States Dollar Spot, Dollar Index represented by US Dollar Index Spot Rate and Oil represented by Generic 1st Crude Oil, Brent.

Gold emerged as the standout performer, delivering a 27% annual return, while the MSCI ACWI Index concluded the year with a robust 18% gain, despite a 2.3% decline in December. The U.S. dollar appreciated by 7% over the year, influencing global trade and placing pressure on emerging market currencies. Oil prices faced volatility throughout 2024, weighed down by concerns over supply gluts and fluctuating demand.

Chart detail: European Credit Default Swaps (CDS) represented by the SNRFIN CDSI GEN 5Y Corp. US CDS represented by US CDS EUR SR 5Y D14.

European CDS levels slightly increased to 63.78 from 62.52 in November, reflecting a modest rise in perceived credit risk within the region. Meanwhile, US CDS levels remained relatively stable, decreasing marginally from 32.95 to 32.93, suggesting continued confidence in the US credit outlook. Looking ahead, potential political turmoil in France and Germany could introduce additional volatility to European credit markets in the coming months.

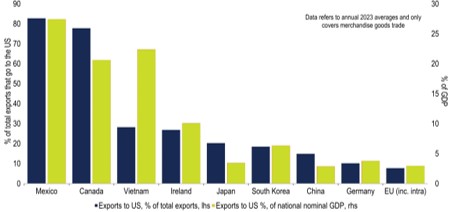

What export markets are most vulnerable to US tariffs?

With Donald Trump’s return to the presidency, economic policy uncertainty is expected to be a prominent topic in 2025. Despite trading partners’ willingness to negotiate, the risk of escalation remains, potentially disrupting trade and harming global economic growth. Moreover, depending on the timing and extent of policy changes, disruptions to global supply chains could further intensify inflationary pressures.

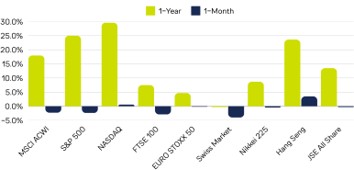

PERFORMANCE

Most indices showed a decline in the last month of the year, but the Hang Seng bucked the trend with a 3.5% gain. Overall, annual performance remained robust, with the NASDAQ leading at 29.6%, followed by the S&P 500 at 25%.

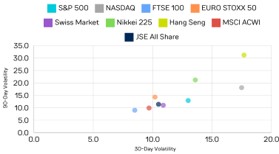

Most indices experienced marginal changes in 30-day volatility in December, with exceptions seen in European, Japanese, and Hong Kong markets, which recorded notable declines. Additionally, 90-day volatility decreased across the board, with the Nikkei 225 showing the most pronounced double-digit drop.