April 2025 Market Overview

Equity markets sold off sharply after Trump’s “Liberation Day” announcement reignited trade tensions, but a 90-day tariff pause and solid economic data helped fuel a swift rebound. Bond markets also reacted, with 10-year US Treasury yields peaking at 4.6% mid-month before easing to 4.2%. Gold hit a record intraday high of $3,500, while Brent crude fell 15.5% on recession fears and increased supply following OPEC’s decision to boost output. As May begins, investors are watching trade talks closely, with several Asian economies facing steep “reciprocal” US tariffs now leading negotiations ahead of their Western peers.

April Recovery Lacks Volume Support

Despite an impressive rebound in the S&P 500 from its intraday low on 7 April, recent trading volumes have remained notably light, as shown in the above chart. While prices rallied, the muted volume suggests limited conviction among investors, with a narrow participation base driving the move. The sharp recovery observed in April bears resemblance to patterns often seen in bear market rallies, where gains can be driven more by short-covering and positioning than broad-based optimism. However, given the uncertain backdrop and absence of a clear directional thesis, it’s too early to determine. We remain in an environment clouded by uncertainty, with no clear long-term bullish or bearish thesis anchoring sentiment.

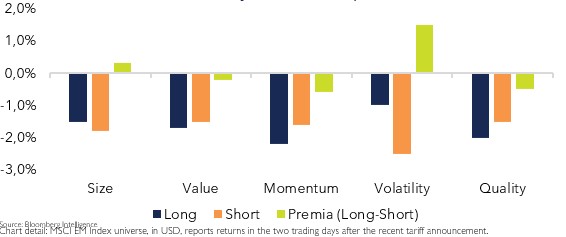

Low-Volatility Factor Outperforms

Following the 2nd of April tariff announcement, investors rotated into low-volatility stocks, seeking stability amid heightened uncertainty. As shown in the chart, low-volatility stocks outperformed high-volatility ones by 1.5%, highlighting a clear “flight to safety” dynamic. Other common investment styles like value, momentum, and quality delivered negative or flat returns over the same period. This pattern reinforces the defensive nature of low-volatility strategies during market stress.

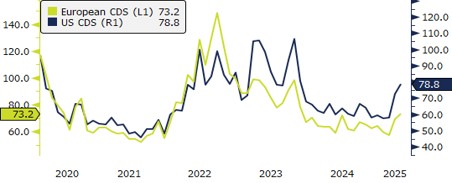

Credit Default Swaps (CDS)

European and US credit default swaps (CDS) ended April slightly below the peaks seen earlier in the month. Market conditions remain volatile, and investors are likely to stay highly responsive to further economic or political developments. As we enter May, European and US CDS have come down further, however market sentiment remains cautious, with inflation data, central bank communication, and geopolitical developments, including Trump’s renewed tariff agenda, all likely to influence direction.

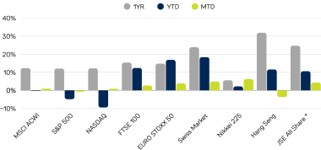

Performance *

* All indices’ performance shown as total returns in USD, except for the JSE All Share Index, which is indicated in ZAR.

Despite a sharp sell-off early in the month most major indices recovered and closed April flat to positive. . The Nikkei 225, Swiss Market, JSE All Share, and EURO STOXX 50 stood out as top performers for the month. Whether April’s rebound proves sustainable remains uncertain, with much depending on how economic data and trade negotiations evolve from here.

Equity market volatility spiked in April, with both 30-day and 90-day measures rising sharply across major indices. The NASDAQ posted the highest 30-day volatility at 52.1, nearly doubling from 27.3 in March. Volatility also jumped in Asia-focused markets such as the Hang Seng and Nikkei 225, while traditionally stable regions like the Swiss Market and EURO STOXX 50 recorded notable increases as well.