January 2025 Market Overview

In January , global financial markets experienced significant volatility, driven by geopolitical tensions and technological advancements. Despite these challenges, major indices ended the month with gains. The Federal Reserve held interest rates steady, stating it was in no rush to adjust policy, while the SARB also kept rates unchanged to support economic stability. Gold prices neared record highs, fueled by a weaker U.S. dollar and investor flight to safety amid economic uncertainty. Meanwhile, Chinese AI startup DeepSeek introduced a cost-effective AI model, disrupting the tech sector and triggering a sell-off in U.S. tech stocks.

Chinese AI startup DeepSeek is emerging as a major disruptor, offering high-performance AI models at significantly lower costs through innovative techniques like model distillation. This affordability could accelerate AI adoption across industries, making advanced tools more accessible. However, DeepSeek faces scrutiny, with U.S. authorities investigating whether it acquired restricted Nvidia chips through intermediaries in Singapore, potentially bypassing export controls. Additionally, the company is facing accusations of intellectual property violations, raising concerns about its use of proprietary technology. Some also question the transparency of its reported development costs. Despite these issues, DeepSeek’s rise signals China’s growing influence in AI, pushing global firms to rethink pricing and innovation strategies. As competition heats up, lower-cost AI tools could drive faster adoption, reshaping the industry landscape.

Chart detail: European Credit Default Swaps (CDS) represented by the SNRFIN CDSI GEN 5Y Corp. US CDS represented by CDX IG FIN CDSI GEN 5Y Corp.

In January 2025, both U.S. and European credit default swaps (CDS) declined, with European CDS showing a slightly larger drop. European stocks reached new highs, with gains in the STOXX 50 and STOXX 600 reflecting pockets of investor optimism despite mixed sentiment indicators, while the ECB’s 25 bps rate cut provided additional economic support.

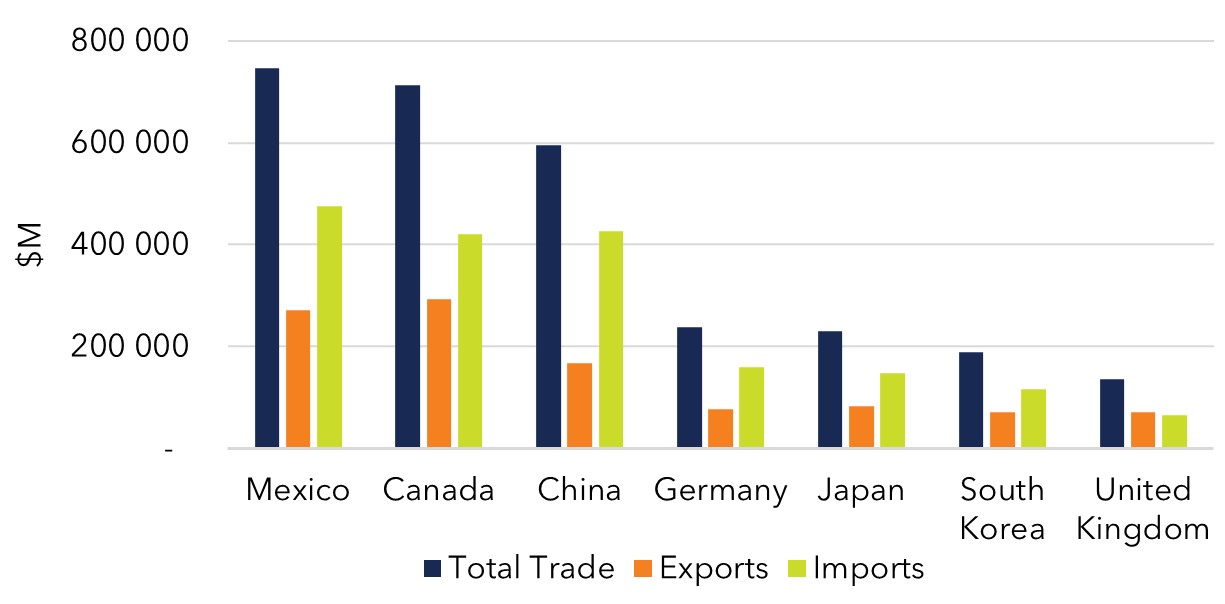

Top US Trade Partners*

Former President Donald Trump initiated a tariff war, imposing 25% tariffs on Mexico and Canada and 10% on China, with retaliation clauses if these countries responded in kind. Despite the broad tariffs, Trump imposed a lower 10% levy on Canadian energy, which is significant given that Canada supplies 60% of US crude imports. Canada has already unveiled its counter tariffs, while Mexico has committed to following suit. Trump justified the tariffs as a response to undocumented migration and illegal drug flow but suggested potential relief if Mexico and Canada addressed his concerns.

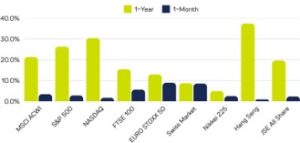

PERFORMANCE

* All indices’ performance shown as total returns in USD, except for the JSE All Share Index, which is indicated in ZAR.

Global equity markets rebounded in January, with all major indices posting positive month-to-date returns following a weak December. European markets led the gains, with the EURO STOXX 50 and Swiss Market surging 8.9% and 8.5%, respectively, while the FTSE 100 also saw a strong 5.6% rise.

All indices, except the Hang Seng, saw a notable rise in 30-day volatility, with the S&P 500 and NASDAQ experiencing the largest jumps to 16.6 and 23.2, respectively. This suggests increased uncertainty in U.S. equities, while European indices saw moderate gains. Meanwhile, 90-day volatility remained largely stable, indicating that recent turbulence has not significantly altered the longer-term trend.