June 2025 Market Overview

Financial markets ended June on a firmer footing, with equities up as near-term volatility eased. A pause in the Israel-Iran conflict pulled oil prices lower, easing some inflation pressure, though broader geopolitical risks remain. Investors are watching for potential new US tariffs and debating Trump’s tax bill, which keeps US debt and spending in focus. The Fed held rates steady, with speculation about future cuts ongoing, while the ECB and BoE continue to balance sticky inflation with softer growth data. Overall, June brought relief, but the second half of 2025 could test markets again as policy and geopolitical uncertainties linger and earnings season gets underway.

Maintaining Caution Amid Uncertainty

Looking back on the first half of 2025, we have navigated a rebound in equities, yet a complex web of risks still hangs over markets as we move into H2. Elevated inflation, uncertainty over tariff impacts, persistent worries about US debt and fiscal spending, and the Federal Reserve’s next moves all add to the cautious tone. Treasury yields remain near multi-decade highs, while geopolitical tensions and trade policy shifts could spark fresh bouts of volatility. Second-quarter earnings season kicks off in July and will test the strength of corporate forecasts, as cost pressures and consumer sentiment remain fragile. For now, we remain cautious, maintaining a neutral stance and refraining from taking active risk. How the second half plays out remains to be seen, but we’re mindful that the road ahead could bring both surprises and setbacks.

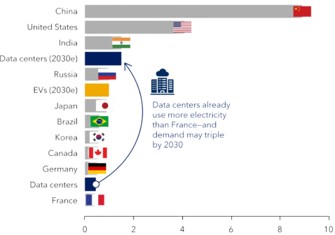

Data Centres Now Compete with Countries for Power

Data centers have already more than doubled their electricity use since 2015 to 2019, and if current trends continue, usage could triple by 2030, rivaling India’s total consumption. While this points to a pressing need for robust energy planning, the outlook remains uncertain. Efficiency gains from models like DeepSeek may ease demand, but wider adoption and more complex AI tasks could push it even higher.

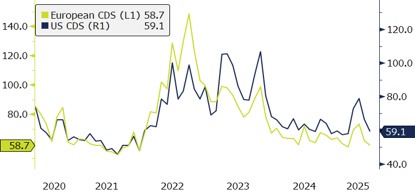

Credit Default Swaps (CDS)

Chart detail: European Credit Default Swaps (CDS) represented by the SNRFIN CDSI GEN 5Y Corp. US CDS represented by CDX IG FIN CDSI GEN 5Y Corp.

CDS levels narrowed further in June, signaling improved credit sentiment and less near-term stress despite lingering macro risks. Both US and European CDS levels are now roughly back to where they started 2025, suggesting a steadier backdrop, though the second half of the year could still hold a few surprises.

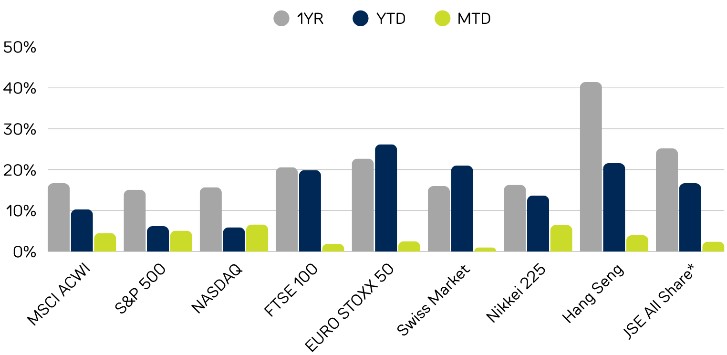

Performance *

* JSE All Share Index, shown in ZAR

Most major indices posted solid month-to-date gains in June, with the MSCI ACWI rising 4.5% as broad risk appetite held firm. The S&P 500 and NASDAQ delivered robust performances, up 5.1% and 6.6% respectively, while Japan’s Nikkei 225 also stood out, gaining 6.5% for the month alone.

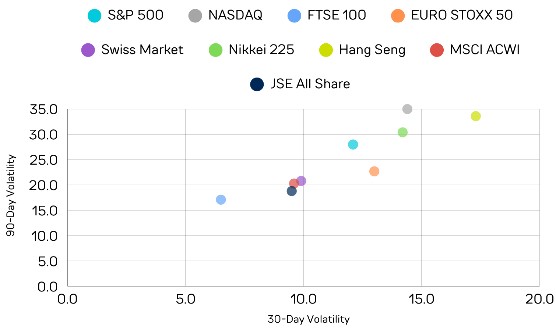

Volatility eased across most major equity markets in June, with 30-day figures trending lower as investor sentiment stabilised. The S&P 500’s 30-day volatility dropped from 18.9 in May to 12.1 in June, while the NASDAQ saw a sharper decline from 23.3 to 14.4. Similar moderation was seen in the Hang Seng and Nikkei 225, reflecting a slight calming of near-term market swings.