March 2025 Market Overview

Global financial markets experienced sharp volatility, largely triggered by President Trump’s announcement of sweeping “reciprocal” tariffs on April 2. Trump indicated that countries could negotiate exemptions if they offered “phenomenal” terms. Amid the uncertainty, futures markets began pricing in 5 Fed rate cuts for 2025. The U.S. dollar weakened against safe-haven currencies, while the Rand came under further pressure, weighed down by global risk aversion and tensions within the GNU over proposed VAT increases and budget decisions. Gold initially rose on safe-haven demand but later retreated as investors covered losses. Earnings season begins this week, adding another layer of focus for markets navigating ongoing turbulence.

Tariff Calculation

The tariffs were described as “reciprocal,” but instead of matching what other countries charge on U.S. goods, they were based on the U.S. trade deficit with each country. The formula was simple: divide the trade deficit by total imports from that country and halve it. For example, South Africa was hit with a 30% tariff because the U.S. imported $14.7 billion in goods but exported only $5.8 billion, creating a trade deficit of $8.9 billion. 8.9 divided by 14.7 is roughly 0.61, and half of that gives the 30% rate.

Policy Rationale

President Trump implemented these tariffs with the stated goals of protecting American industries, reducing trade deficits, and encouraging companies to relocate manufacturing to the United States. He suggested that the tariffs would generate significant revenue for the federal government, potentially offsetting other taxes and contributing to national debt reduction. He also argued that by making imported goods more expensive, consumers would be more inclined to purchase American-made products, boosting domestic production and job creation.

However, these objectives are not always aligned, and attempting to pursue them simultaneously may result in conflicting outcomes and unintended consequences. One could argue that the strategy overlooks the complexity of global supply chains, the elevated costs of domestic production, and the significant workforce demands required to scale U.S. manufacturing. This raises doubts about whether the tariffs will be enough to drive a large-scale return of production to American soil.

Repercussions

Some firms may absorb these higher costs to protect market share, while others may pass them on to consumers through price increases. However, elevated prices may suppress consumer demand, as households reduce discretionary spending, thereby exerting downward pressure on business revenues and overall economic activity. Even for companies that don’t raise prices, reduced profit margins leave them with less capital to invest in growth, potentially slowing hiring or leading to job cuts.

Analysts have already revised down their growth forecasts, warning that tariffs could drive up consumer prices and contribute to inflation. Federal Reserve Chair Jerome Powell cautioned that the combined effect of rising costs and weaker demand could tip the economy toward a slowdown or even a recession. With inflation and stagnating growth occurring in tandem, the risk of stagflation, defined as a period of rising prices coupled with weak economic performance, has also come into focus. Still, many effects may take time to materialise, and there is significant uncertainty around how the full impact of the tariffs will play out in the months ahead.

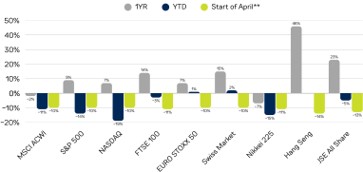

Performance *

* All indices’ performance shown as total returns in USD, except for the JSE All Share Index, which is indicated in ZAR.

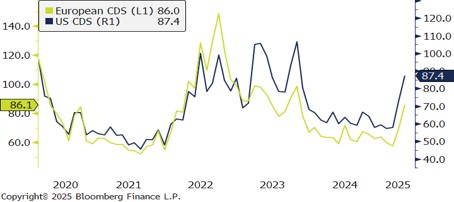

Credit Default Swaps

Chart detail: European Credit Default Swaps (CDS) represented by the SNRFIN CDSI GEN 5Y Corp. US CDS represented by CDX IG FIN CDSI GEN 5Y Corp.

The effects of the trade tariffs are evident in the sharp rise in credit default swap (CDS) spreads, signaling heightened concern among investors about credit risk and economic stability. As of April 7, 2025, U.S. CDS widened from 57.0 at the end of February to 87.4, while European CDS rose from 57.4 to 86.0. Unlike external shocks, this is a man-made disruption driven by policy decisions, which has triggered volatility and renewed concerns about the stability of the global economic outlook.

Staying the Course

We don’t claim to make forecasts or predict market outcomes. Instead, we observe carefully, remain patient, and avoid the temptation to be overly clever in uncertain times. Markets value consistency, and recent volatility reflects the level of uncertainty currently priced in. These phases are not new, as markets have always cycled through periods of anxiety and adjustment. For us, the key indicator is liquidity. As long as liquidity remains intact, the system is functioning. It is when liquidity starts to dry up that real concern sets in. In the meantime, we remain steady, with a prepared shopping list of opportunities we continue to monitor. When the dust settles, we will be ready to act with clarity and conviction.